At the dawn of a new era, women in Japan still face old challenges: they’re paid less than men and struggle to scale the professional ladder. How can the impasse be broken?

Environmental, social and governance (ESG) requirements in stock exchanges are emerging around the world, showing that global investors are exploring ways to integrate such factors into their investments – aiming to generate not only positive returns but also positive impacts. “Stock exchanges are uniquely positioned at the intersection between investors, companies and regulators. As such they can

Environmental, social and governance (ESG) requirements in stock exchanges are emerging around the world, showing that global investors are exploring ways to integrate such factors into their investments – aiming to generate not only positive returns but also positive impacts. “Stock exchanges are uniquely positioned at the intersection between investors, companies and regulators. As such they can play a key role in promoting responsible investment and sustainable development,” in the words of James Zhan, Director of Division on Investment and Enterprise for the United Nations Conference on Trade and Development (UNCTAD).

Stock exchanges are regulated financial markets where securities (bonds, notes and shares) are bought and sold at prices governed by demand and supply. In order to be listed on an exchange, conditions and statutory requirements are imposed on companies. These vary between exchanges but include: a minimum number of outstanding shares, minimum market capitalisation, and minimum annual income. Sustainability requirements have started to become a norm in stock exchange requirements and leading exchanges around the world have set sustainability standards as a prerequisite for companies to be listed on them.

One of the key drivers behind pushing sustainability requirements in exchanges is the United Nations’ Sustainable Stock Exchanges (SSE) initiative. Launched in 2009, it brings together stock exchanges, regulators, investors and other key stakeholders to promote improved disclosure and performance on ESG issues. It is co-organised by UNCTAD, the Principles for Responsible Investment (PRI), UN Environment Programme Finance Initiative (UNEP-FI) and UN Global Compact (UNGC).

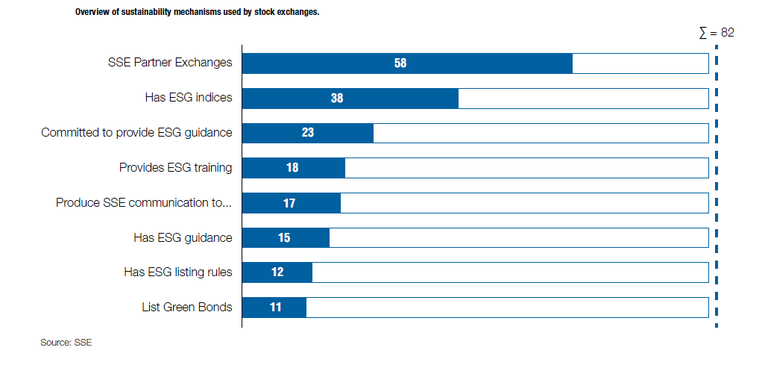

58 stock exchanges, representing over 70 per cent of listed equity markets, have made a public commitment to advancing sustainability and are now official SSE Partner Exchanges. 12 currently incorporate ESG reporting into their listing rules, 17 provide formal ESG guidance to issuers and an additional 21 exchanges could introduce sustainability reporting standards in the near future.

The current economic growth path is being increasingly recognised as vulnerable because of its short-term outlook and the lack of value given to socio-environmental impacts on corporate performance. This is also due to a lack of disclosure of ESG information by listed companies. Exchanges can ensure that investors have consistent, comparable and high quality information on how companies are positioning themselves in terms of sustainability risks and challenges.

While governments remain the most prevalent initiators of policy instruments aimed at sustainability disclosure, BM&FBOVESPA, Bursa Malaysia, the Johannesburg Stock Exchange and Stock Exchange of Thailand prove that exchanges are successfully encouraging sustainability disclosure through their ability to direct and mandate the reporting behavior of their listed entities, as highlighted in the 2016 Corporate Knights report.

One of the instruments for mobilising capital in favour of environmentally responsible projects are green bonds. Green bond listings on exchanges have grown considerably: today, 11 stock exchanges offer green bond listings, therefore supporting the transition to a green economy. Listed green bonds provide transparency, visibility, enhanced compliance with market regulations, liquidity and trading facilities for investors. Information about how proceeds from listed green bonds are used is publicly available, allowing investors to compare bonds at their disposal.

If every constituent of the Standard & Poor’s 500 Index could reduce their direct emissions to zero, the impact would be roughly equivalent to removing all the emissions produced in France, Germany and Britain combined. (Timothy Edwards, S&P Dow Jones Indices Director)

Another way of mobilising green capital is through ESG indices listed on stock exchanges, constructed based on the performance and impact of member companies across ESG factors. They’re often used by global ESG investors to define the investment universe for their region and test investment strategies with ESG indicators. Such indices remain the most popular sustainability instrument among exchanges, with 38 of 82 exchanges providing them. For example, through its Socially Responsible Investment (SRI) Index, the Johannesburg Stock Exchange (JSE) employs a broad range of criteria including issues specific to South Africa such as Black Economic Empowerment and HIV/AIDS. In 2010 the JSE upgraded its ESG reporting requirements to include integrated reporting on a “comply or explain” basis, making South Africa the first country to mandate that all listed companies disclose financial and non-financial performance in a single integrated report. Other stock exchanges providing ESG indices are:

Global stock exchanges are already making changes to address the United Nations’ Sustainable Development Goals (SDGs), a set of global goals for the year 2030. For example, BM&FBOVESPA for the first time will make it compulsory for the constituents of its Corporate Sustainability Index (ISE) to disclose their SDGs policies in order to participate in the index.

Supporting small and medium-sized enterprise in job creation is an integral part of achieving SDG 8. In line with this, the Stock Exchange of Thailand launched the Social Impact project to encourage listed companies to allocate both financial and non-financial resources to social enterprises (profit-making companies tackling environmental and social challenges) across Thailand.

To address SDG 12, the Santiago Exchange created the Dow Jones Sustainability Chile Index (DJSI Chile) in 2015 to promote environmentally and socially responsible processes in listed companies. Similarly, in 2011 the Securities and Exchange Board of India mandated a set of guidelines for reporting ESG information, requiring the 500 largest companies listed on the Bombay Stock Exchange and National Stock Exchange to produce business responsibility reports. These 1,000 companies represent over 95 per cent of the market capitalisation of the Indian equity market.

There is a strong case for stock exchanges to strengthen ESG disclosure requirements especially in emerging markets that are often characterised by poor ESG disclosure. Stock exchanges have the ability to encourage a shift towards more sustainable behaviour by enforcing a systematic approach to ESG corporate reporting within listing rules, promoting the adoption of global corporate governance codes, offering benchmarking products such as sustainability indices and addressing the SDGs.

Siamo anche su WhatsApp. Segui il canale ufficiale LifeGate per restare aggiornata, aggiornato sulle ultime notizie e sulle nostre attività.

![]()

Quest'opera è distribuita con Licenza Creative Commons Attribuzione - Non commerciale - Non opere derivate 4.0 Internazionale.

At the dawn of a new era, women in Japan still face old challenges: they’re paid less than men and struggle to scale the professional ladder. How can the impasse be broken?

Inequality has increased anywhere in the world despite substantial geographical differences, with the richest 1% twice as wealthy as the poorest 50%. The results of the World Inequality Report 2018.

We talk to Samir de Chadarevian, an expert in sustainable development, philanthropy, impact investing and social innovation.

The global gender gap or index has widened, the 2017 World Economic Forum report shows. In view of the International Day for the Elimination of Violence against Women, we analyse how these phenomena are sadly related.

We can learn a lot from philanthropists and families investing their money for the future of all of us. We talk about this with Gamil de Chadarevian, founder of GIST Initiatives.

How do wealthy families invest their capital? Fortunately, impact investing is an increasingly common choice. An anticipation of some of the most important findings.

All companies aim to profit, but some of them are doing something for the society. They’re called benefit corporations.

More and more wealthy families care about our Planet. Data emerged from the Investing for Global Impact prove this.

In the next few months LifeGate will host a series of in-depth analyses on philanthropy and impact investing. This section is supported by Investing for Global Impact, a global research published by The Financial Times in partnership with GIST (Global Impact Solutions Today) and with the support of Barclays. Why philanthropy and impact investing, together In